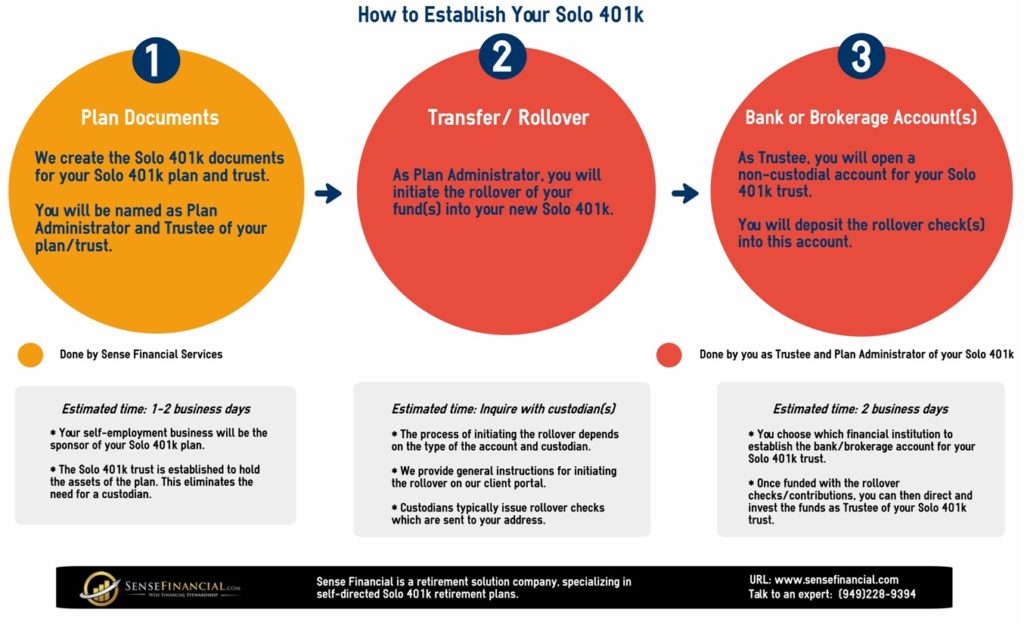

Infographics: How to Establish a Solo 401k for Retirement?

If you don’t have a strong legal or financial understanding, it could be a challenge to establish a Solo 401k plan. Our team has put together a small infographics to help you get started.

Infographic: How to establish a Solo 401k plan

Plan Documents

The first part of the process involves the creation of your Solo 401k plan documents. Our team will create plan documents required to establish a Solo 401k plan.

You will become the plan administrator and trustee of your plan/trust. The Solo 401k trust is established to hold the assets of the plan. Further, it eliminates the need for a custodian.

Estimated Time: It should take anywhere between 1 to 2 business days.

Transfer/Rollover

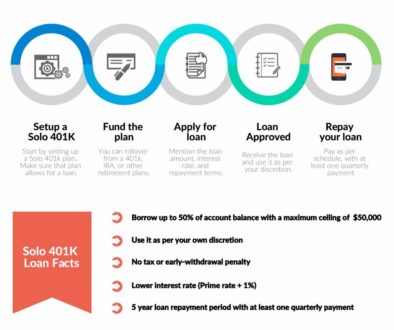

Once your plan is established, the next step is to roll over money from your existing retirement accounts to the newly created Solo 401k plan.

The process of initiating a rollover depends on the type of plan and the custodian. In order to help you process the rollover, we offer general instructions to initiate the rollover on our client portal. In most of the cases, the custodian issues a rollover check, which is then sent to your registered address.

Related: Solo 401k plan rollover- How to fund your Solo 401k?

Bank or Brokerage Account

After making qualified rollovers, it is time to open a non-custodial bank account for your Solo 401k plan. Your rollover checks will go into this account.

When you’re establishing a Solo 401k plan, make sure to choose a financial institution that aligns with your target features, starting with low or now processing fess, lower maintenance charges, and immediate fund transfers.

Once your bank account has money, you’re ready to invest it. A self-directed Solo 401k account offers multiple venues to put your money, including both traditional and non-traditional assets.