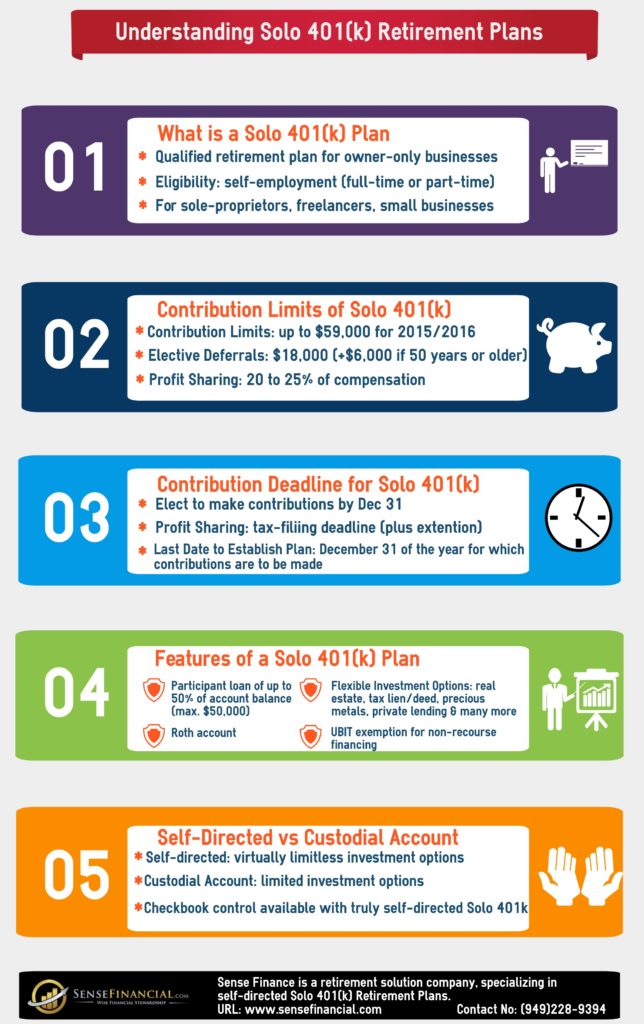

Solo 401(k) Infographic: A Realtor-Friendly Retirement Plan

Real estate is one of the most tried and tested recipes of generating sustainable wealth. What is even better is the tax shelter it offers, especially for high-income individuals. Working with real estate investors as our primary clientele, we hear some terrific investment strategies. One of our clients, Bill, bought an organic Mango farm in Panama, followed by a Neem tree farm in Brazil. The best part of the transaction was that he was able to use his self-directed Solo 401(k) retirement funds for the purchase.

Bill isn’t the only client enjoying success in real estate investing with his retirement funds. We hear similar stories on a regular basis.

Why invest in real estate with a self-directed Solo 401(k)?

Real estate comes with several qualified deductions, keeping your tax bill in check. However, if you are looking for an option to lower your tax bill further, self-directed Solo 401(k) could be the answer.

- Equity gains from a property sale go directly into the Solo 401k, saving you from immediate taxation.

- Rental income flows directly into the Solo 401(k) account, keeping your tax bill lower.

- Any repairs or expenses go directly from Solo 401(k) plan, lowering your financial burden.

- You can use non-recourse financing to fund your purchase without paying UBIT.

- With a Roth Solo 401(k) retirement plan, you enjoy completely tax-free returns.

- Your money enjoys tax-deferred growth over the next two to three decades.

At the same time, real estate bought through a self-directed Solo 401(k) plan follows the same transaction rules as that of your regular real estate transaction. Aside from saving on taxes, you can also take advantage of the compounding effect to grow your wealth with the tax-deferred benefit.

Want to learn more about the Solo 401k plan? Here is a short infographic to highlight the key features of a self-directed Solo 401(k) retirement plan.